Investor appetite continues to grow for “restaurant tech” companies as more restaurateurs digitize their ordering, payment and delivery systems. And next on the menu is the sector’s biggest tech challenge—the kitchen.

Digitization of the kitchen is a sexy concept right now because there’s a lot of pain there in the industry.

Restaurant employees are under more pressure than ever in a competitive market with razor-thin margins, Struck said. “You also have a massive sort of restaurant labor shortage. So people are trying to use core technology innovation to just streamline operations.”

In an industry where many kitchens run on paper orders and recipes printed from Word documents, restaurant tech companies are seeing more opportunities in the back of the house. By digitizing the kitchen, a restaurant can not only store recipes, track orders and manage inventory, but also reduce food waste, cut costs and tap new revenue streams.

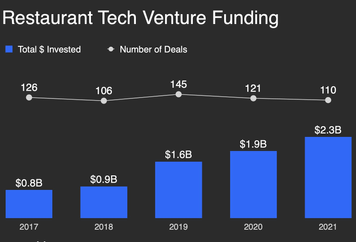

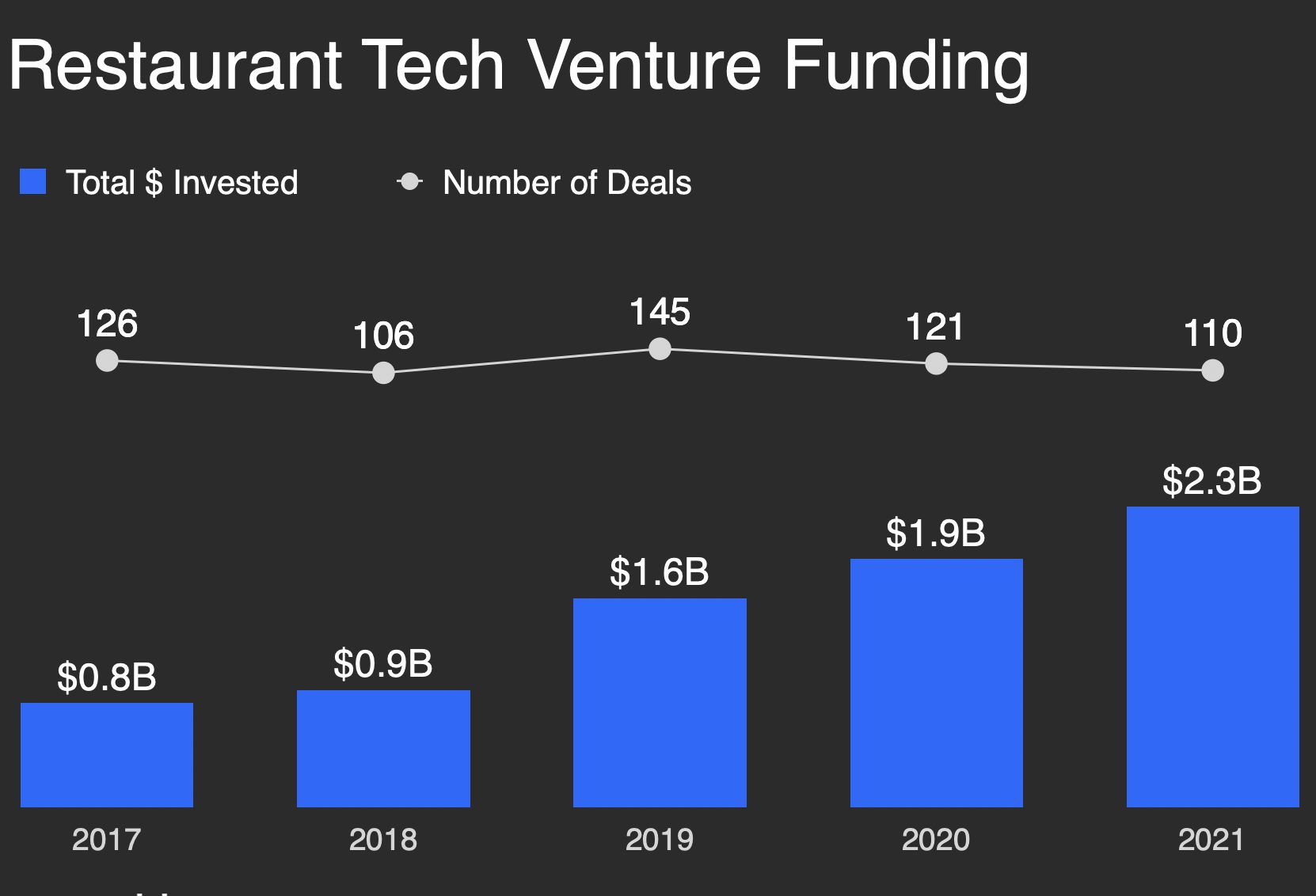

Restaurant tech as a whole has seen a steady rise in venture investment, from about $800 million in 2017 to $2.3 billion in 2021, according to Crunchbase data. While the number of deals per year slipped lower in 2020 and 2021, the value of individual deals increased.

Companies targeting the restaurant payment process scored especially big in 2021. Examples include San Francisco payments and accounts payable platform PlateIQ, with a $160 million Series B round in November, and QR code payment app Sunday, which raised $100 million in its Series A round.